Michelle Peluso, CMO, IBM Corporation

Michelle Peluso, CMO, IBM Corporation Today’s shoppers regularly abandon online carts, visit brick-and-mortar stores then make online orders and comparison-shop mercilessly; leaving retailers with the challenge of creating differentiated and personalized shopping experiences to win the majority share of the shopper’s wallet.

“Retailers must evolve from emphasizing transactions to focusing on building intimate, unique customer relationships”

Global research by IBM shines light on the behaviors and expectations of the “next-gen” shopper. These customers embrace, and are empowered by the latest wave of technology advances—and have a strong appetite for a more personalized shopping experience.

The 2017 Global Customer Experience Index by IBM Global Business Services (GBS) surveyed 507 brands across eight market segments in twenty-four countries. The study focused on seven areas of the shopping experience: personalization, digital experience, omni-channel supply chain, physical and digital integration, social media, mobile experience, and the in-store experience.

The results include finding significant opportunity for retailers to improve the customer experience: on a scale of 0 to 100, the overall Customer Experience Index average was only 33. Further, among the brands surveyed, only 3.4 percent are categorized as Leading Edge, scoring 60 points or more on the CEI, leaving great opportunity for a new approach to engage customers.

Even though over half of the brands were rated very good or excellent for their digital experience, research shows that it remains inconsistent. The study also found a mere 19 percent of brands offer more than a basic level of personalizing the online experience—which is far less than what today’s customer expects. Also, 38 percent of brands provide either a poor mobile experience or none at all, and only 31 percent of brands allow customers to access their data on a mobile app. The need for a seamless experience across all digital channels is imperative for retailers to build and maintain customer loyalty.

A frictionless shopping experience is particularly important for brands that want to appeal to the next big buying tribe: Generation Z. The births of U.S. Gen Zers outpaced millennials by 3 million, and globally represent a combined spending power of $44 billion. A survey by the IBM Institute for Business Value (IBV) of 15,000 consumers age 13-21 from 16 countries shows that despite being “digital natives”—98 percent of this growing and high-spending demographic surprisingly prefer to shop in-store.

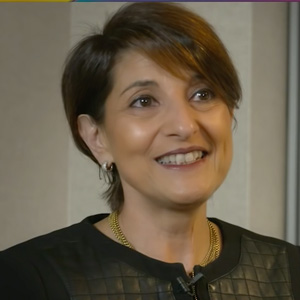

Laurence Haziot, Global Managing Director, Consumer Industries, IBM Corporation [NYSE:IBM]

Laurence Haziot, Global Managing Director, Consumer Industries, IBM Corporation [NYSE:IBM]The study also analyzed their digital habits, finding 74 percent of respondents said they spend free time online, with 25 percent of Gen Zers spending five hours or more online each day. Their preferred channel is mobile, with 73 percent of the respondents stating they primarily using mobiles to text and chat socially with family and friends—and they want that engaging conversation to naturally extend into their brand relationships. 42 percent all respondents said they would participate in an online game for a campaign, 43 percent would participate in a product review, and 36 percent would submit ideas for product design. They love collaborative engagement and feel like they are contributing to the brand.

Not surprisingly, IBM’s study found that 60 percent of Gen Z respondents will not use an app or website if it is too slow to load or hard to navigate. With their preference to shop in with the expectation of product availability, the Consumer Experience Index showed retailers are not serving up in-store innovations to meet their needs. The study found 84 percent of brands did not offer any in-store mobile services, plus 79 percent of brands did not give associates the ability to access customer account information via a mobile device. The slow integration of mobile and physical channels to serve the always-on customer leaves them with growing levels of dissatisfaction, which leads to a loss of the customer—unless retailers make changes to their approach.

The Retail Imperative: Shift from Transactions to Relationships

Retailers must evolve from emphasizing transactions to focusing on building intimate, unique customer relationships with each individual consumer. One that not only keeps them engaged both in store and online, but also builds loyalty to ensure they will be a customer in the future.

If you fail to engage your customers, someone else will. From traditional manufacturer brands going direct, to digitally native startups such as Dollar Shave Club and Bonobos, to disruptors like Uber-eats-conventional retailers are now experiencing an onslaught of new and unpredictable competitors.

Retailers Blazing an Innovation Trail with Cognitive

Cognitive computing is able to comprehend both structured data, such as customers’ past browsing history, and unstructured data, such as images, videos, and bodies of text—and learns over time from previous interactions. In essence, it builds the capability to understand and reason much like humans do—through senses, learning and experience—to personalize the customer experience.

For example, YOOX NET-A-PORTER GROUP S.p.A. (YNAP)— the world’s leading online fashion luxury—is working with IBM to develop one shared technology platform across all of YNAP’s multi-brand and mono-brand online stores. The streamlined order management system with cognitive capabilities will provide a personalized shopping experience for high-value consumers. This will support all of its customers and luxury brand partners. Besides Net-A-Porter, the Milan, Italy-based company, powers the online stores of brands such as Emporio Armani, Valentino, Moschino and numerous others. The technology will provide customers access to “one global virtual inventory,” aimed at creating higher sell-through rates and retail margins.

YOOX NET-A-PORTER GROUP is a pinnacle example of how brands can creatively use cognitive and cloud technologies to harness the customer to build relationships. Other technologies will form part of this approach in 2017 and beyond—for example, expect to hear and see more about chatbots, connected cars, and cognitive marketing solutions to help retailers identify hidden insights in massive amounts of data at industry events such as January’s NRF Retail Big Show this past week.

Consumers do not see channels; they see brands. Retailers must provide a consistent experience across all touchpoints—and leverage innovative, value-add technologies to actively interact and engage with shoppers to affirm, build and grow the brand relationship.

Tackling these challenges should not be seen as a project, but viewed as a mindset of continual transformation. Retailers who embrace this mindset will win the hearts and wallets of the next gen shopper.

Check Out : Top Cognitive Startups

Read Also